Aleph Zero: Under the Radar Layer-1?

Hi Everyone 👋

Welcome to Gm Crypto, a weekly newsletter discussing different topics in crypto and the broader Web3 world.

Over the past few months, I have consistently seen $AZERO (Aleph Zero) appear in my Twitter feed and this weekend my curiosity led me to learn more about it. After diving into the protocol, I believe Aleph Zero has potential for massive growth over the next few years leading into the next 2024-2025 bitcoin halvening. A breakdown of the protocol is below.

Value Proposition:

Aleph Zero intends to act as a privacy enhancing public blockchain solving the shortcomings of current distributed ledger technologies (DLTs) including speed, validation time, scalability, and security. Aleph Zero will operate as a public ledger as well as a private instance connected to a public ledger, allowing for enterprises to build decentralized projects that benefit from the speed and security of a public DLT platform while still being able to preserve the privacy of their transactions.

Vision:

The Aleph Zero team believes now is the time for a “post-blockchain” protocol that adheres to the progressive principles set forth by Satoshi Nakamoto. The team has expressed concern that the current state of decentralized ledger technologies (DLTs) is moving towards centralized, permissioned and leader-based environments in which a small number of individuals are in control of each network, thereby creating liabilities and single points of failure. Aleph Zero however cultivates an open, scientific approach with a constant flow of ideas that can guarantee true progression of the domain. Overall, the goal of Aleph Zero is to make it possible for server message blocks (SMB’s) and enterprises to communicate at a rate close to what they would expect with regular internet communication while still utilizing the benefits of decentralization.

Features (Described more here):

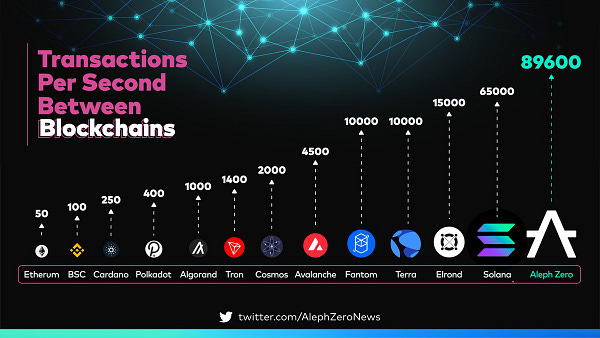

Scalability - Up to 100,000 tx/s (transactions per second) and in a recent laboratory test achieving 89,600 tx/s with a 416 ms confirmation time in a decentralized test setting of 112 AWS nodes spread across five continents. For reference, below are some other protocol transaction speeds.

Low transaction costs - On average a transaction on the network costs 0.0003 $AZERO

Decentralization - DAG (directed acrylic graph) based network that utilizes a 100+ node committee that rotates every 15 minutes from a set chosen every 24 hours

Common wallet - Low latency and privacy enhancing decentralized exchange and wallet that mitigates MEV, and bridges between blockchains

Private smart contracts - customization functionality for automation and programmable contracts that are scalable and self executing

Hub and spoke model - Allows businesses to have a “private instance” that interacts with the main decentralized public ledger, allowing for trustless, cheap and efficient interactions while maintaining their own private network

File storage - Application Programming Interface (API) hooks that allow seamless integration into InterPlanetary Fill System (IPFS) as well as proprietary data solutions

Harry’s View:

Aleph Zero’s differentiator is the implementation of a DAG (directed acrylic graph) based model, which varies slightly to what is generally considered a blockchain. Unlike a blockchain, which consists of blocks, directed acyclic graphs have vertices and edges with transactions recorded on top of each other. Blockchains force a total order on transactions simply by adding a new block to the chain. By allowing for a looser structure of how to represent transactions, a DAG relieves the bottleneck of imposing order before it is needed. A DAG orders transactions only when they’re needed, which improves the efficiency of the system. The transaction time can be a fraction of what it is in blockchains. The different structure of DAGs allows protocols to concurrently process transactions independently. A further explanation can be found here.

Furthermore, the “hub and spoke” model as coined by the Aleph Zero team allows for the benefits of both a public and private ledger. The public network can work as a “hub” and is suitable for holding the data that can and should be accessible by the general public. At the same time, private chains or “spokes” connected to the public record can enhance the security of other aspects of governing while still operating internally, with access control. The hub and spoke model positions Aleph Zero well as privacy and trust concerns become increasingly relevant in the broader crypto market.

Tokenomics:

At a price of ~$1.01 (as of 11/06/22), Aleph Zero has a market cap of ~$186M. The token was initially launched to the public around $0.10 before reaching a high of $3.07 and since falling in value. There are currently 183 million tokens in circulating supply with a maximum supply of 300 million (61% issued). Pre-seed and seed round investments were made at $0.04 and $0.057, respectively and can be observed here. Below is a market cap comparison of $AZERO compared to other L1 protocols. While prices have changed since the creation of this visual, the message is the same. With a relatively low market cap for an L1 token and almost two thirds of the supply already issued there is significant potential for $AZERO to grow in token value over the next few years.

Conclusion:

Generally, the crypto market is still severely overcrowded with different tokens and protocols. While the crypto market has begun to consolidate slightly over the last 12 months I still expect many more protocols to be flushed from the market in the coming years. Aleph Zero could be one of these protocols, but in my view I believe they have a good chance to remain relevant in the crypto atmosphere with their unique value proposition. With in-demand protocol capabilities/products and a vision that aligns with the general ethos of the broader crypto community, Aleph Zero appears to be a dark horse positioned for potential success in the future. I am excited to follow the developments of this team and see whether the DAG based protocol vision will gain more traction over time.